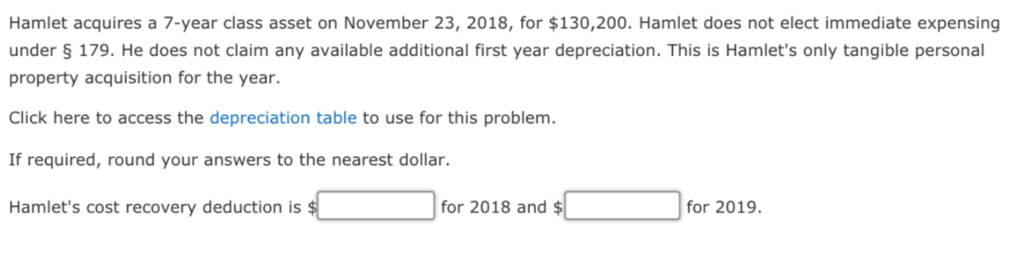

Hamlet Acquires a 7 Year Class Asset on

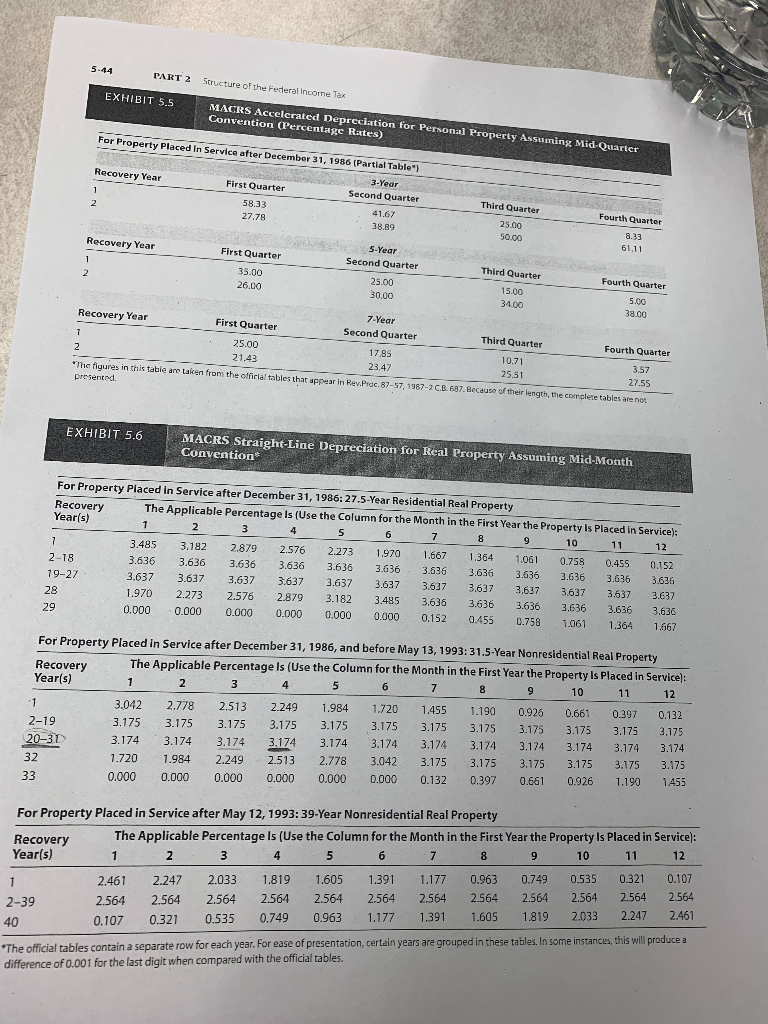

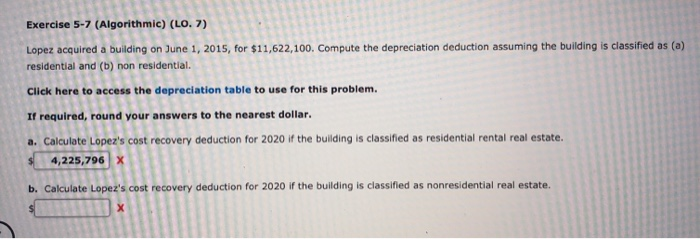

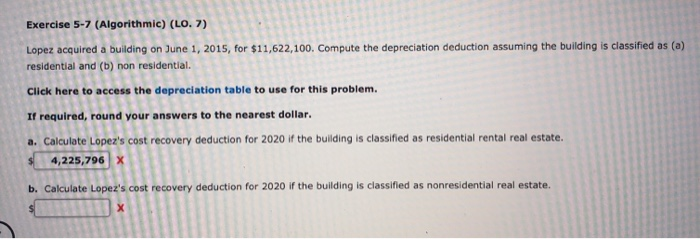

He does not claim any available additional first-year depreciationHamlets cost recovery deduction is ______ for 2019 and ______ for 2020. This is Hamlets only tangible personal property acquisition for the year.

Hamlet Acquires A 7 Year Class Asset On November 23 Chegg Com

Hamlet acquires a 7-year class asset on November 23 2020 for 100000 the only asset acquired during the year.

. South Western Federal Taxation. This is Hamlets only tangible personal property acquisition for the year. Hamlet acquires a 7-year class asset on November 23 2016 for 100000.

If required round your answers to the nearest dollar. He does not claim any available additional first-year depreciation. He does not claim any available additional first-year depreciation.

Hamlet does not elect immediate expensing under 179. Hamlet does not elect immediate expensing under 179. Hamlet does not elect immediate expensing under 179.

Calculate Hamlets cost recovery deduction for 2020 and 2021. He does not claim any available additional first-year depreciation. Hamlet does not elect immediate expensing under 179.

7 Hamlet acquires a 7-year class asset on November 23 2020 for 172200 the only asset acquired during the year. Calculate Hamlets cost recovery deductions for 2016 and 2017. He does not claim any available additional first-year depreciation.

He does not claim any available additional first-year Depreciation. Calculate Hamlets cost recovery deduction for 2020 and 2021. This is Hamlets only tangible personal property acquisition for the year.

He does not claim any available additional first-year depreciation. Hamlet does not elect immediate expensing under 179. He does not claim any available additional first-year depreciation.

Calculate Hamlets cost recovery deductions for 2016 and. Hamlet acquires a 7-year class asset on November 23 2019 for 264600 the only asset acquired during the year. Hamlet acquires a 7-year class asset on November 23 2021 for 382200 the only asset acquired during the year.

If required round your answers to the nearest. This is Hamlets only tangible personal property acquisition for the year. He does not claim any available additional first year depreciation.

He does not claim any available additional first-year depreciation. Sandstorm Corporation decides to develop a new line of paints. He does not claim any available additional first year depreciation.

Hamlet acquires a 7-year class asset on November 23 2018 for 100000. Hamlet acquires a 7-year class asset on November 23 2021 for 247800 the only asset acquired during the year. If required round your answers to the nearest dollar.

Hamlet acquires a 7-year class asset on November 23 2019 for 483000 the only asset acquired during the year. Hamlet does not elect immediate expensing under 179. Hamlet acquires a 7-year class asset on November 23 2020 for 100000 the only asset acquired during the year.

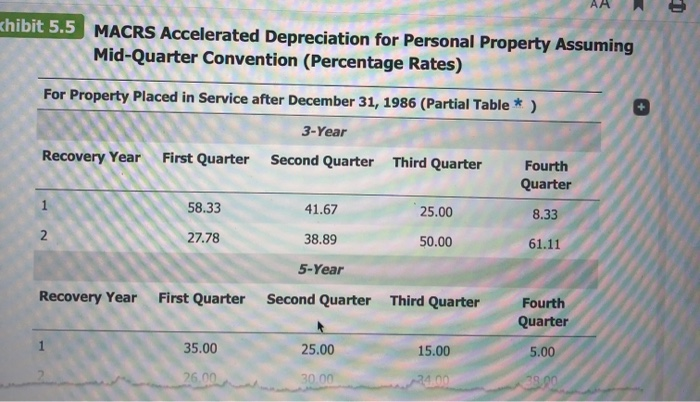

Click here to access the depreciation table to use for this problem. This is Hamlets only tangible personal property acquisition for the year. He does not claim any available additional first year depreciation.

Hamlet does not elect immediate expensing under 179. Calculate Hamlets cost recovery deductions for 2015 and 2016. He does not claim.

Hamlet acquires a 7-year class asset on November 23 2016 for 100000. Click here to access the depreciation table to use for this problem. Hamlet acquires a 7-year class asset on November 23 2021 for 491400 the only asset acquired during the year.

Hamlet does not elect immediate expensing under 179. Hamlet does not elect immediate expensing under 179. Click here to access the depreciation table to use for this problem.

He does not claim any available additional first year depreciation. He does not claim any available additional first year depreciation. Hamlet does not elect immediate expensing under 179.

Hamlet acquires a 7-year class asset on November 23 2015 for 100000. Hamlet acquires a 7-year class asset on November 23 2016 for 100000. Hamlet acquires a 7-year class asset on November 23 2019 for 100000.

Hamlet does not elect immediate expensing under 179. He does not claim any available additional first-year depreciation. This is Hamlets only tangible personal property acquisition for the year.

Hamlet does not elect immediate expensing under 179. Click here to access the depreciation table to use for this problem. This is Hamlets only tangible personal property acquisition for the year.

Hamlet acquires a 7-year class Asset on November 23 2015 for 100000. Hamlet does not elect immediate expensing under 179. Hamlet acquires a 7-year class asset on November 23 2020 for 197400 the only asset acquired during the year.

Hamlet does not elect immediate expensing under 179. Hamlet does not elect immediate expensing under 179. Hamlet does not elect immediate expensing under 5 179.

Hamlet does not elect immediate expensing under 179. Hamlet does not elect immediate expensing under 179. He does not claim any available additional first year depreciation.

Hamlet does not elect immediate expensing under 179- He does not claim any available additional first-year depreciation. Hamlet acquires a 7-year class asset on November 23 2018 for 100000. This is Hamlets only tangible personal property acquisition for the year.

Calculate Hamlets cost recovery deductions for 2015 and 2016. Hamlet acquires a 7-year class asset on November 23 2020 for 390600 the only asset acquired during the year. Hamlet does not elect immediate expensing under 179.

Hamlet does not elect immediate expensing under 179. Hamlet acquires a 7-year class asset on November 23 2020 for 407400 the only asset acquired during the year. He does not claim any available additional first year depreciation.

Hamlet acquires a 7-year class asset on November 23 2018 Hamlet acquires a 7-year class asset on November 23 2018 for 100000. He does not claim any available additional first year depreciation. Hamlet acquires a 7-year class asset on November 23 2016 for 100000.

Hamlet does not elect immediate expensing under 179 He does not claim any available additional first-year depreciation. Hamlet acquires a 7-year class asset on November 23 2016 for 100000. He does not claim any available additional first year depreciation.

If required round your answers to the nearest dollar. Hamlet acquires a 7-year class asset on November 23 2017 for 100000. This is Hamlets only tangible personal property acquisition for the year.

Solved Hamlet Acquires A 7 Year Class Asset On November 23 Chegg Com

Solved Exercise 5 6 Algorithmic Lo 7 Hamlet Acquires A Chegg Com

Solved Exercise 5 6 Algorithmic Lo 7 Hamlet Acquires A Chegg Com

No comments for "Hamlet Acquires a 7 Year Class Asset on"

Post a Comment